Nicht alles ist mit der Weltwirtschaft und dem Weltfinanzsystem in Butter. So führt die BIS zu den Risiken in ihrem aktuellen Jahresbericht 2016/2017 aus:

“First, leading indicators of financial distress signal risks from high private debt and house prices in several economies that were not at the epicentre of the Great Financial Crisis (GFC). Second, in some countries, high household debt might become a significant drag on demand, especially if rising interest rates boost debt service burdens. Third, persistent weak productivity growth and high corporate debt could weigh on investment. Fourth, the rise in protectionist sentiment could hurt the economic prospects of small open advanced economies and EMEs in particular.”

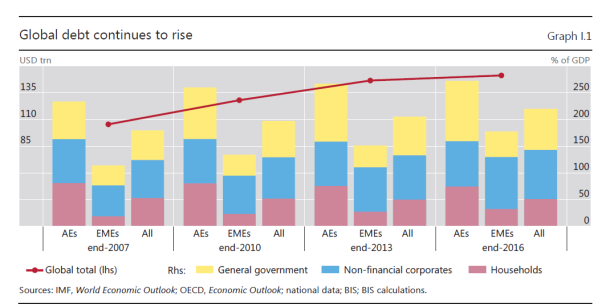

Kernproblem ist demnach die fortbestehende hohe Verschuldung der Industrieländer (AEs) und die steigende Verschuldung der Emerging Countries (EMEs), die einhergeht mit außerordentlich hohen Assetpreisen auf den Aktien, Immobilien und Bondmärkten.

Die globale Verschuldung nimmt zu

Die Herausforderung sieht die BIS im Management des aktuell höchst ungewöhnlichen Kredit- und Finanzzyklus. So heißt es im Report:

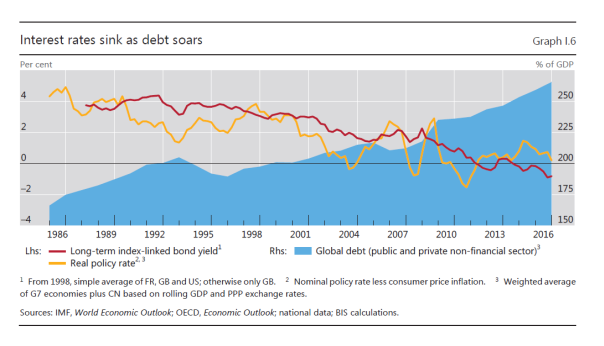

„Tackling the financial cycle would call for more symmetrical policies. Otherwise, over long horizons, failing to constrain financial booms but easing aggressively and persistently during busts could lead to successive episodes of serious financial stress, a progressive loss of policy ammunition and a debt trap. Along this path, for instance, interest rates would decline and debt continue to increase, eventually making it hard to raise interest rates without damaging the economy (Graph I.6). From this perspective, there are some uncomfortable signs: monetary policy has been hitting its limits; fiscal positions in a number of economies look unsustainable, especially if one considers the burden of ageing populations; and global debt-to-GDP ratios have kept rising.”

Sinkende Zinsen gehen mit steigender Verschuldung einher